Please note: this blog article contains affiliate links and links to my shop where I sell products and promote products I use and recommend. If you choose to make any purchase using the links on this blog, I will earn a small commission.

Today is Tax Day in the United States. It’s the deadline to file tax returns.

Ideally, if you are a US resident or citizen, you would have already filed by now, have gotten an extension or are hurredly scrambling to get it done by tonight’s midnight deadline.

Irrespective of where you are in the above category, if you are a social media influencer, performer, blogger, or other online content creator, you’re responsible for reporting the income you receive from your online activities.

Even if you are a part time creator, and you have a full time job that pays your bills, you are considered self-employed or an independent contractor by the brands, influencer platforms and social media platforms that pay you in creator rewards.

You won’t receive a W-2 from the companies that sponsor you. Instead, you’ll receive a Form 1099-NEC from each partner that pays you $600 or more.

Keep in mind that you are required to report all income that you received on your tax return, even if it is less than $600.

Therefore, the income you make must be included and summarized on Schedule C, Profit or Loss from Business form when you file your taxes. If you just spend that money, don’t track it and have no plans to file a Schedule C or did not file one this year, know that you are at risk of being audited because the brands, platforms and payment processors will be letting the IRS know that money was sent to you and Uncle Sam will be looking for accounting from YOU for that money.

If you didn’t file a Schedule C, it’s not too late to ask for an extension or to amend your returns to include it.

Now, this does not mean you will be on the hook for taxes because if you have a full time job, you could be receiving a BIGGER return once you report the expenses that will be considered deductions related to your content creation business.

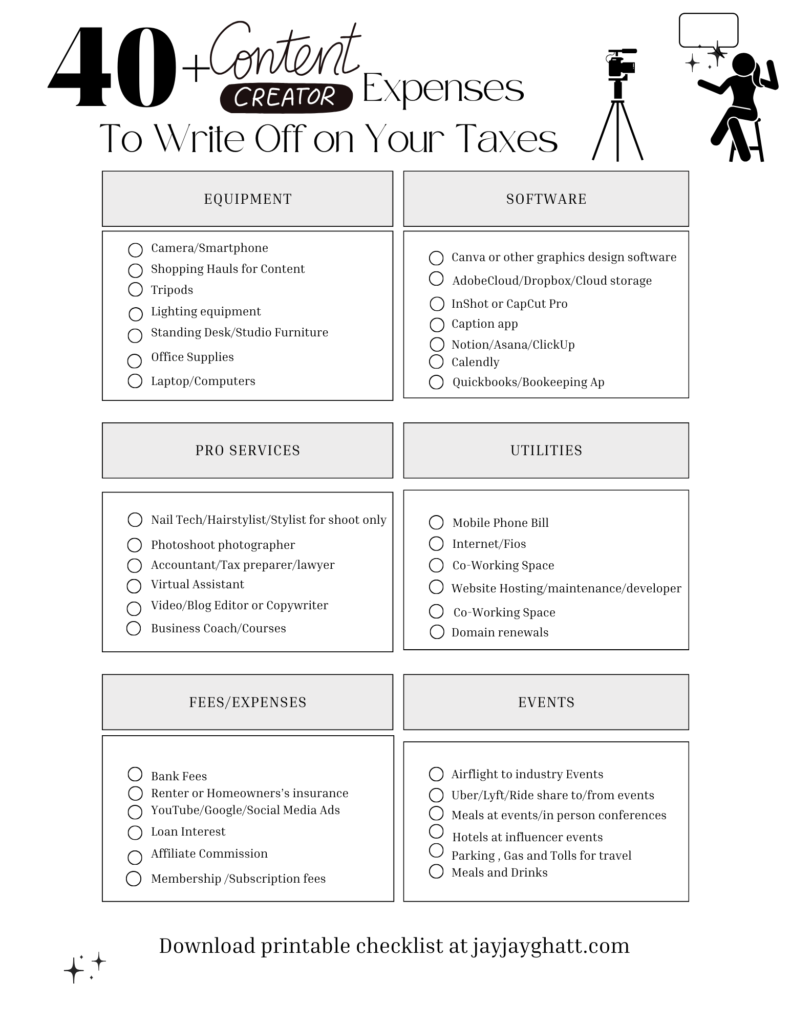

Below is a summary of the expenses and below that is a chart that you can download.

Here’s a comprehensive guide to essential expenses content creators can write off on their taxes.

- Equipment and Gear: One of the most significant expenses for content creators is equipment. Cameras, microphones, tripods, lighting equipment, and even computers and software used for editing are all essential tools of the trade. You can deduct these expenses in full or the depreciated value of these expenses over time! If you’re looking to upgrade your equipment, check out my recommendations on my Amazon shop here!

- Home Office Expenses: If you have a dedicated space in your home used exclusively for creating content, editing or working on your creator business, you may be able to deduct a portion of your rent or mortgage, utilities, internet bills, and other related expenses. Be sure to keep accurate records and calculate the percentage of your home used for work to maximize this deduction. I use Intuit QUICKBOOKS to track your expenses and it is actually integrated with the online bank that I use for my content creator LLC.

- Software and Subscriptions: Content creation often requires various software tools and subscriptions. Whether it’s Adobe Creative Cloud for photo and video editing, hosting services for your website or podcast, or social media management tools, these expenses are generally deductible as long as they are directly related to your business. I use the professional version of Cap Cut, InShot, Canva and several other free apps and I write off the cost!

- Travel Expenses: Attending industry events, conferences, or even traveling for content creation purposes can be deducted. Even if you’re invited to a brand trip or event, there are a lot of days when you are on your own and have to pay for your own meals. Some require you to pay for your airport transportation. All of these expenses including lodging, meals, and other necessary expenses incurred while traveling as a creator can be expensed. Again, keep detailed records and receipts to substantiate these deductions. Another platform to consider which is less expensive than Quickbooks and doesn’t have a monthly expense and has a one-time fee of $49 that you can use is Billed! Here are some others that promise to replace Quickbooks.

- Marketing and Advertising: In this era where algorithms are not showing your content to your followers, you might have to actually come out of pocket and pay for ads to grow, reach your target audience and generate revenue! Expenses related to marketing and advertising, such as social media ads, Google AdWords, or sponsored content, can be deducted as business expenses.

- Professional Services: If you hire professionals to help with aspects of your content creation business, such as graphic designers, editors, or accountants, their fees are generally deductible. Be sure to keep records of payments and contracts to support these deductions. If you would like to hire me to set up your LLC, help you formuate a social media plan for your business and have a budget of at least $250, I can do that for you! Start with a consultation here and you can write it off on your taxes next year!

- Education and Training: We all know that courses can get expensive but you can lessen the blow by writing off that expense. So, if you invested in courses, workshops, a business coach or seminars,virtually or in person, to improve your skills as a content creator can also be deducted. Whether it’s learning new editing techniques, improving your writing skills, or mastering social media marketing, these expenses are considered legitimate business deductions. And if you don’t have a big budget for courses and don’t yet know about Udemy, then head over there next to explore some of the low cost courses available!

- Office Supplies and Expenses: From notebooks and pens to printer ink and postage, the costs of running your content creation business add up. These expenses are deductible as long as they are directly related to your business activities. Staples.com is my fave source for office supplies. I also have some supplies on my Amazon shop.

- Website Expenses: If you have a website for your content, expenses related to domain registration, hosting fees, website design, and maintenance are all deductible. Your website is often the primary platform for showcasing your content and engaging with your audience, making these expenses essential for your business. I have used GoDaddy for years anc have several websites hosted at Dreamhost as well. Hostgator is a great source for hosting as well. For a low cost domain, consider Web.com and Name.com.

- Health Insurance Premiums: If you’re self-employed, you may be able to deduct the cost of health insurance premiums for yourself, your spouse, and dependents. This deduction can help offset the high costs of healthcare and is a valuable benefit for self-employed content creators.

Understanding and maximizing your tax deductions as a content creator is crucial for optimizing your financial situation and ensuring long-term success.

By keeping detailed records, staying organized, and consulting with a tax professional, you can take full advantage of the tax benefits available to you and keep more of your hard-earned money in your pocket.

Remember, tax laws and regulations vary by country and region, so it’s essential to stay informed and seek guidance from qualified professionals familiar with the intricacies of tax law in your jurisdiction. With proper planning and attention to detail, you can minimize your tax liability and focus on what you do best – creating amazing content for your audience.

Good luck, creators! Get that paper, coin or bag, whatever your generation call it! lol!

Let’s discuss more! Meet me in social media @jayjayghatt everywhere!

DOWNLOAD this LIST HERE!